Rethink your mortgage because it matters.

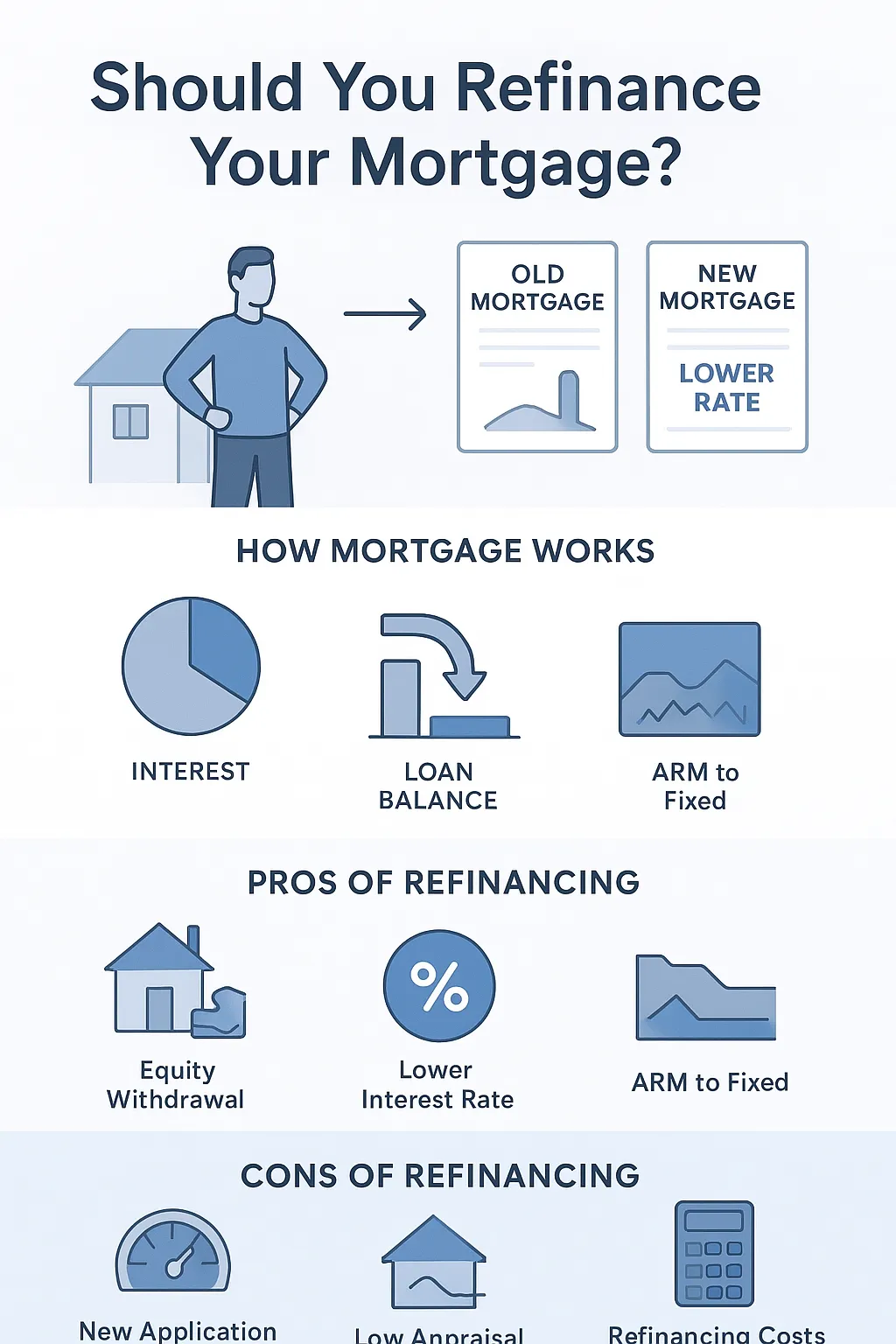

You realize that mortgage interest rates are low, but you've invested in a fixed-rate mortgage. In the context of this, the decision of whether or not to refinance your mortgage arises. Refinancing a mortgage requires getting a new loan and refinancing it with a new payment schedule.

The following are the fundamentals of how a mortgage works. When you make a payment, a portion of it will be applied to your interest. The remainder of your payment will be used to the principle of your initial loan. The more your payment goes toward the principal, the sooner you'll be able to pay off your loan. The more payments you make on your mortgage, the more your original loan principal is reduced.

Pros Of Mortgage

Equity can be withdrawn:

Equity is the gap between the amount owed to your lender and the value of your home. Selling your home is one method to check your equity. If relocation is not in your immediate plans, cash-out refinancing is an alternative. You take out a loan against your home's equity and pay down the bulk of the current principal sum. You may use the additional money to pay off debt, fund your children's education, improve your house, or start a company. This is also risky because it adds to your debt and may raise your mortgage payment.

Furthermore, exchanging unsecured debt for a home-secured loan might result in the loss of your home if you cannot make regular mortgage payments.

Lower Interest Rate:

The most common reason for refinancing your home loan is to save money on interest. Refinancing can help those going through a financial crisis maintain their houses while also protecting their credit.

Converting an adjustable-rate mortgage to a fixed-rate mortgage: Adjustable-rate mortgages provide lower rates in the early years of the mortgage term than fixed-rate mortgages. ARMs are ideal for persons who do not intend to stay in their homes for a lengthy amount of time. If you're buying a home to live in for a long time, a fixed-rate mortgage is a better option to prevent unforeseen interest rate spikes.

Cons of Mortgage

Applying for a new mortgage:

If your credit score has dropped, you've just lost a job, or your salary has decreased, mortgage brokers may deny your refinancing request. When enrolling in a new plan, your credit and income become quite substantial. To verify your income, your lender may ask for copies of your most recent salary and tax records.

Low-Ball Appraisal and Costs of Refinancing:

Home appraisals determine the value of your home and are necessary for refinancing. The appraiser will compare similar transactions in the neighborhood to determine the home's worth, and the results might significantly impact refinancing. The lender will decline the refinancing request if the anticipated property value is less than the present loan.

Costs of Refinancing:

Refinancing comes with a price tag. Most homeowners must pay closing fees, which can vary from 3% to 6% of the loan principal.

The application cost, credit report fee, house appraisal fee, title search fee, loan origination fee, and discount points are all included in the fee.

Today is the best time to contact Lending Experts!

If your credit score, income, and general financial situation are all in good shape, refinancing may result in more savings. It is, however, a time-consuming procedure. Obtaining expert assistance can assist you in your quest to improve your mortgage strategy.

To chat with highly trained and experienced mortgage brokers, contact Lending Experts in RateLock.ca right now to determine your mortgage rate and learn more about our services.